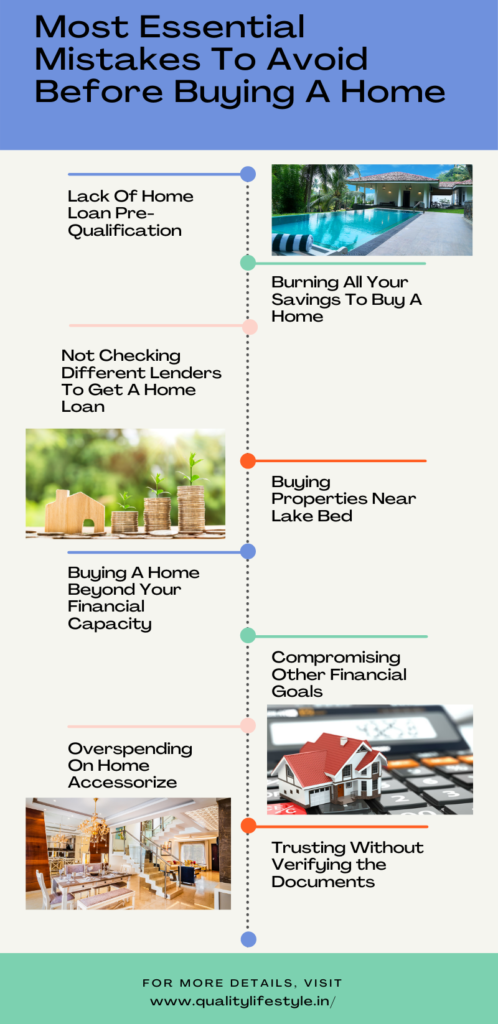

The Complete Guide On Mistakes To Avoid Before Buying A Property

When it comes to purchasing a property, a small mistake will cost you a lot. The process of buying a property comes with certain complexities, especially for first-time homebuyers. Here is a quick guide on some of the most essential mistakes to avoid before buying a property

Having Limited Options

The fear of losing any good offer will often result in hasty decisions, especially while purchasing a property. It is important to keep your options wide open. Take your time to research various properties that suit your budget and location while considering the credibility of the developer. The real estate market is huge, and as a homebuyer, you can be rest assured that there is always an option that meets their budget and other preferences.

Opting Ready-To-Move Properties

Some homebuyers are keen on buying only ready units for several reasons. However, your options increase manifold with under-construction properties as compared to ready units. The offers are better for ongoing projects in terms of livable space, location, amenities and most importantly the price. The only drawback is the waiting period, but sufficient research about the market will help you to identify projects nearing possession. The price advantage of an under construction property outweighs the rent outflow for that period if the builder has a reputation of delivering projects on time, like NVT Quality Lifestyle.

Buying Properties on No-Construction Buffer Zone

Residential projects near water bodies are risky because of the current situation of the lakes in the country. Gone are the days, when homes around lakes used to sell with a premium tag, as it had a higher probability of price appreciation.

When it comes to investing in a project near the lake bed in the city, ensure that the seller has all the regulatory clearances in place. Additionally, it is very important to follow all the norms set by the National Green Tribunal (NGT) strictly. In Bangalore city, the Bangalore Development Authority (BDA), has regulations to enforce no-construction buffer zones around lakes and storm water drains (SWDs).

In May 2016, the National Green Tribunal (NGT) extended the buffer zone limit. The respective development authority of the city can take action and demolish properties encroaching lakebeds and storm water drains. Be wary of huge discounts for such properties.

ZippServ protect is a tool to identify such encroached properties in the city. It just takes five minutes to spot lake encroachments based on revenue maps.

Legal Validation of Property Documents

First-time homebuyers often rely on recommendation of others while investing in a property. It is prudent to get a legal verification of all the documents before investing in a property. Make a checklist of the following documents before buying a property:

Sale Deed

It is the core legal document that acts as proof of sale and transfer of ownership of the property from the seller (individual or real estate companies) to the buyer.

Mother Deed

It is one of the most important parent legal document that traces the origin/antecedent ownership of the property from the start.

Building Approval Plan

The development authority of the city, for example, Bangalore Development Authority (BDA), Bangalore Metropolitan Region Development Authority (BMRDA) etc, sanctions a building plan of the builders.

Commencement Certificate for Under-Construction Property

Local authorities such as BDA, BMRDA etc issues the commencement certificate after the inspection of the project site. It is also one of the essential legal documents.

Conversion Certificate (Agricultural to Non-Agricultural Land)

This certificate confirms the use of the land from agricultural to non-agricultural purpose from the competent revenue authority.

Occupancy Certificate for a Constructed Property

A builder obtains this certificate only after the completion of the construction. Respective local authorities carry an inspection to ensure that the construction meets all the specified norms.

Some of the other important documents are Khata Certificate and Khata Extract, Encumbrance Certificate (EC), Betterment charges receipt, Power of Attorney (POA), Latest tax paid receipt and Completion Certificate for a constructed property.

Financial Mistakes to Avoid while Buying a Home

According to BankBazaar’s Aspiration Index 2019, buying a house was the topmost life goal for over 1800 salaried men and women across 12 cities. However, it should not go to an extent of putting your short and long term goals at stake. Then the question arises: how far you should stretch yourself to buy a home?

Lack of Home Loan Pre-Qualification

Several first-time homebuyers will find a property that suits their preferences after sufficient research about the market. Then, they may rush to grab the deal which might lead to settling for the first home loan being offered to them. This results in missing out on other exciting offers from different banks and financial institutions. The main factor that differentiates a good and a bad home loan is its rate of interest, tenure, low penalty rate, low cost of borrowing, less processing time, flexible prepayment rates and friendly loan eligibility norms.

Before entering the realty market, getting your home loan pre-approved is one of the essential steps. Real estate companies need to know homebuyer’s paying capacity. This will also help you to judge your loan repayment potential as per the market standards.

Not Keeping the Down Payment Ready

The down payment on a home is often between 10% and 25% of the value of the property. It is very important to save for a down payment rather than borrowing from other sources for huge interest. The down payment amount depends on your budget preferences. For instance, if the property price is valued at Rs. 50 lakh, the down payment might be between 5 lakh and 12 lakh. Additionally, there are other considerable non-loan expenses like registration, stamp duty, a title deed, brokerage, GST, water supply charges etc. In case, failing to arrange your down payment and other charges, you will end up spending your emergency fund or forced to borrow long with high interest from your friends and relatives.

It is wise to draft a detailed financial plan without negatively affecting your emergency budget. This will give you a clear picture of the financial challenges that occur during the process of raising funds.

Can You Afford the Home?

Remember, big houses are not always the best ones for a homebuyer, who is looking for affordable homes. From a financial perspective, the best practice is to own a home, which you can afford in the long run without negatively affecting your other financial needs. A big house in a posh locality will have more features and premium specifications. Therefore, it is essential to be clear about the needs of you and your family members.

Analyze your financial capability to service the EMIs without making an emotional decision of owning a home in a good neighborhood. Do fatcor in the maintenance costs. It is always best to buy a property that you can afford as per your present repayment capacity. In the long term, your financial status may increase along with your expenses. So buying a home according to your existing repayment capacity is always the right choice.

Compromising Other Financial Goals

Buying a home is one of the most significant events in one’s life. Does it align with your short term and long term goals such as your retirement, children’s education?

In short, it’s vital to have a smart financial approach and proper verification process, while buying your dream home.

Check out NVT’s Villa projects near Whitefield and Sarjapura.