NRI Property Investment: Key Points To Remember Before Investing In India

Non-Resident Indians (NRIs) have been long tempted by investments in Indian real estate market because the concentration of NRIs in the developed counties is huge. Eventually, with the currency of the developed countries being stronger than a developing economy like India, NRI property investment in India has gained traction in the past few decades.

Keep these Documents ready before Investing

Buyers must make these primary documents ready before making a property investment in their country of origin:

Passport and/or OCI card: NRIs must show their Indian passport. If you hold a foreign passport, you can buy property in India provided you have a PIO (Persons of Indian Origin) card or an OCI (Overseas Citizen of India) card.

PAN Card: This is mandatory for property transactions.

Power of attorney: NRIs must provide a power of attorney in case they’re not in India for executing the purchase transaction. Please note that you will need a special power of attorney which is registered and notarized and not a general power of attorney to execute a property transaction.

To get a home loan, NRIs must furnish the following documents:

- Copy of Indian passport and visa (If Indian passport is unavailable)

- PIO Card (If you hold a foreign passport)

- OCI Card (If your parents are citizens of India)

- Work permit/employment contract/appointment letter of your country of residence

- Latest salary certificate / Payslips for the last six months

- Latest income tax returns

- Bank statement of NRE and NRO accounts for the last 1 year

- Bureau report of the country of residence

- Power of attorney in the format provided by the bank (in case you are not in India for executing the purchase transaction)

FEMA Rules to be Kept in Mind

Any cross-border monetary transaction either to or from India is governed by FEMA (Foreign Exchange Management Act) 1999, which came into effect after the FERA act was repealed and regulates all transactions that deal with foreign exchange. Here are the five most important FEMA regulations every NRI must know.

Maintenance of bank account

#1 Once you become an NRI, you need to open certain bank accounts that are designated for NRIs. These include:

- An NRO account if you send money earned abroad back to India

- An NRE account where for repatriable or moveable, assets, such as securities and cash.

- A FCNR (B) account that stores money in foreign currency. Both NRO and NRE are only used for rupees. Financial investment options

#2 NRIs are allowed unlimited investment in repatriable or non-repatriable transactions. The only exceptions are small savings schemes or Public Provident Fund (PPF) that aims to mobilize small savings by offering an investment with reasonable returns combined with income tax benefits.

#3 Acquisition and transfer of immovable properties

All NRIs and Persons of Indian Origin (PIO) (excluding those from some countries) can purchase all types of residential and commercial real estate in India. The exceptions are the following:

- Agricultural land

- Plantation

- Farm homes

#4 Repatriation of current and immovable assets

An NRI can send money back to India on foreign repatriable assets such as rent received from a building owned abroad. He is more restricted on immovable assets (such as property and lands), since the NRI can only be repatriated on his originally invested foreign fund. He cannot profit from any sort of ROI that proceeds from these investments. Before remitting funds abroad, know how you will be taxed for it in the US.

#5 Income for students

According to the Liberalized Remittance Scheme, Indian students who are NRIs can receive a maximum of US$ 10 lakhs per year from their NROs or NREs, or from any profit gained from properties or estates. NRI students can also receive an amount equivalent to US$ 2.5 lakh per year for caring for close relations.

Types of Properties where NRIs can Invest

An NRI is allowed to invest in both residential and commercial properties in India. However, any agricultural land, farmhouse and plantation property can be owned, only if it is inherited or gifted to the NRI.

Financial Transactions by NRIs

When it comes to property transactions in India, NRIs/ PIO can make payments out of:

- Funds remitted to India through normal banking channel.

- Funds held in NRE/ FCNR (B) / NRO account maintained in India.

- No payment can be made either by traveler’s cheque or by foreign currency notes.

- No payment can be made outside India.

Loan Eligibility

Bakshi elaborates that “Like normal Indian citizens, NRIs/PIOs too can avail of home loans in Indian rupees for their property purchases, up to 80 per cent of the property value, depending upon individual eligibility. Such a loan can be repaid:

By way of inward remittance through normal banking channels.

By debit to his NRE / FCNR (B) / NRO account.

Out of rental income from such property.

By the borrower’s close relatives, as defined in Section 6 of the Companies Act, 1956, through their account in India, by crediting the borrower’s loan account.”

Taxation

NRIs can earn returns from their investments in real estate, in the form of rental income and short or long-term gain.

Rental income

The rental income earned from a property asset in India, falls under the income accrued in India and is taxable, irrespective of residential status.

Short-term capital gains

Short-term capital gains apply on the profit earned through the sale of a property, within two years of its purchase. The capital gains for such property are calculated as the difference between the sale proceeds and the cost of acquisition. It is taxed as per the applicable slab rate for the NRI.

Long-term capital gains

Long-term capital gains (applicable when the property is held for more than two years) are taxed at 20 per cent. However, unlike short-term capital gains, the exemption can be claimed under sections 54, 54 F and 54 EC.

If an NRI invests in an under-construction property, they may have to give a power of attorney to a trusted associate, for completing the deal. Hiring a lawyer to prepare the document, is also crucial, to ensure that there is no forgery and the investment is secure.

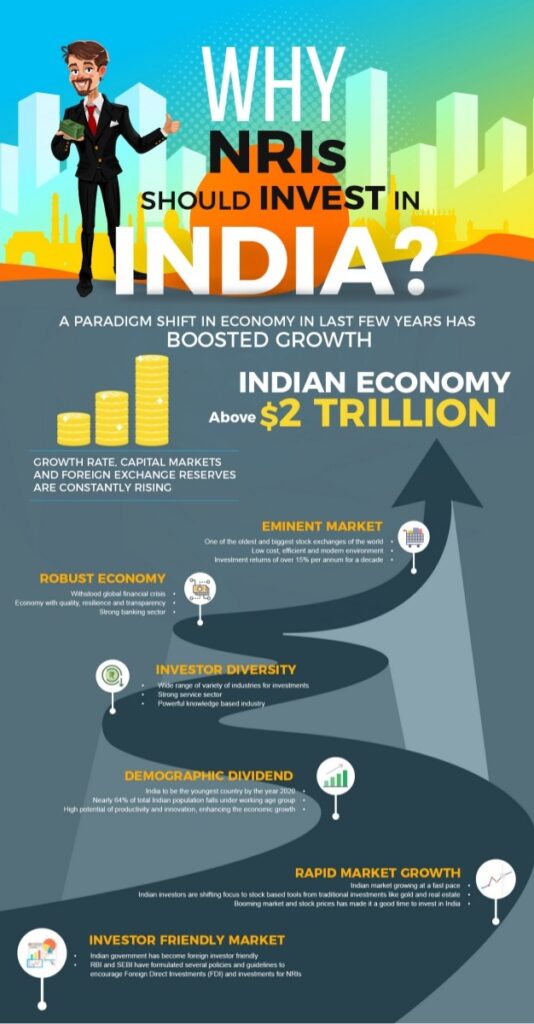

Why should an NRI Invest in a Property in India?

IC: Karvy Stock Broking

Undoubtedly a plush lifestyle abroad may entice people to become an NRI but a connection with the root is something that fetches a sense of belongingness very necessary for existence. Apart from these, there are several other reasons for an NRI to invest in India. Few of them are lower cost of homes compared to the prices of the country they live in or other developing countries. Moreover, the rate of price rise of real estate has always been more in India than that of the developed nations. This assures more returns on investment.

Furthermore, the fall in Rupee value against respective currencies would always help them to gain more which is an added advantage. The NRIs would always have an option to return to India if they have a home of their own and more importantly the facility of reverse mortgage would help the senior NRIs to maintain a secured retired life as the money borrowed from the banks in the way of a reverse mortgage is not taxable.

If long-term NRI investment and a higher rate of return are on your mind then you should invest in Indian property. But as long as consumer protection is concerned India has introduced RERA which has brought in more transparency and attempts to protect the end-users. For all these reasons and few other Indian properties has always been of interest for the NRIs but of late there has been a renewed interest for the NRIs to own Indian property. The reasons for it are also numerous. Below we list the reasons why Indian real estate is of interest to the NRIs and PIOs.

Where to Invest?

When it comes to gaining a higher return on investment from the property, Bangalore is considered as the best place to invest in India. The city provides enormous job and business opportunities every year, as a result, there is a high demand for residential properties, which also attracts several infrastructural development projects from the government. NVT Quality Lifestyle is one of the best real estate companies fulfilling the growing needs of a high-end residential villa in Bangalore.

Reasons for the Increased Interest Rate for NRIs on Property

There has been increased interest in Indian properties by NRIs owing to the following reasons:

- With the introduction of RERA, the consumers’ risks have been considerably reduced with improved buyer’s sentiments.

- With renewed interests and an environment under GST, it provides more confidence and comfort to the investors.

- The consumer sentiments are expected to improve gradually as GST, RERA, and the amended provisions of insolvency and bankruptcy transform real estate into a consumer-friendly sector.

- The year 2017 witnessed a turnaround period after RERA and GST was introduced bringing in more transparency surging buyers’ sentiments resulting in more enquiries & bookings.

- The affordable housing sector has got a renewed boost not only due to a drop in the price but also due to the government rolling out various incentives and measures for first-time home buyers.

NRI’s Checklist for Property Investment

As the NRIs have an impediment to come to India often and check the property they are investing in, it is imperative that they are cautious about this and choose the right property and avert risks of delayed possession or even dispossession. Notwithstanding these risks the Indian real estate has grown in leaps and bounds in the last decade and investing in it would not only give the opportunity for the NRIs to be connected to their roots but would also bring good returns for the expatriate investors. On the flip-side, there have been numerous cases where NRI buyers have been misguided about the delivery time of the property or even the size and structure of it and have been duly exploited. The risks are undoubtedly manifold but taking precautions and doing the checks would prevent you from the risks and keep you protected.

IC: Holistic Investment Planners

We list the checks below that you need to follow to finalize the deal in a hassle-free manner.

Do thorough Background Checks of the Builder

Conduct a thorough background check of the builder and visit the past projects with due diligence with the customers. Check the past projects of the builder and check the track record of the builder physically.

A Site Visit is Mandatory

Although you may check the credibility of the builder on the internet duly checking the reviews but it’s still mandatory to come to India once and visit the site at least once. Before investing a large amount of money, it’s mandatory that you visit the site and check the construction procedure and quality as reversing your decision may prove to be even more costly. If it is utterly impossible to visit yourself, you can ask your local representative or any relative to conduct the checks for you.

Avail a Housing Loan

Choose a project that’s approved by national banks as banks would have already done the due diligence about the builder and the project before approving the project. A housing loan from such a bank would ensure that the money is released from the bank in stages and the loan is pre-approved.

Maintenance of the Property

Maintenance is a major issue or concern and makes sure that there are some society or association for the maintenance of the property. In metro cities, you would also get professional property maintenance management firms that you can enlist as an alternative.

Measure the Built-up area

Make sure the construction area that is quoted is for the built-up area or whether it is the carpet area. The area that is quoted is often the super built-up area that includes the staircase, lobbies, common passages, etc. but you should always know the built-up area. The carpet area is normally 15 to 20% lesser than the built-up area.

Check-Shortlist-Negotiate-Finalize

The right way to choose and finalize a property is to check 100 properties, shortlist 20 out of them, scrutinize them and start negotiating with 10 of them and then finalize one of the 10 that best suits your need. This is suggested by the real estate experts and analysts and is popularly called the 100-20-10-1 rule.

Check the Statutory Approvals

After you complete the above steps and finalize a property it is mandatory to check the statutory approvals like water supply, Airport, fire, sewage disposal, town planning, safety approval, approval from the fire department, etc.

Take Sufficient Time

It’s a great mistake to finalize a deal in a hurry when you come for a sojourn. Rather than that, render any of your relative or friend the power of attorney (POA) on your visit to India. In case you can’t decide or shortlist a property that you would buy in your short tenure of a visit to India your friend or relative would act on your behalf to decide the right property for you to buy it even after you leave India.

Check out NVT’s completed and ongoing projects here.