Renting Vs Buying A House – Which Is Better?

Buying a house you can call your own is the dream of every Indian. Property prices are sky-rocketing in metropolitan cities that has made people opt for renting rather than owning a property. When it comes to renting vs buying a house, budget plays a vital role.

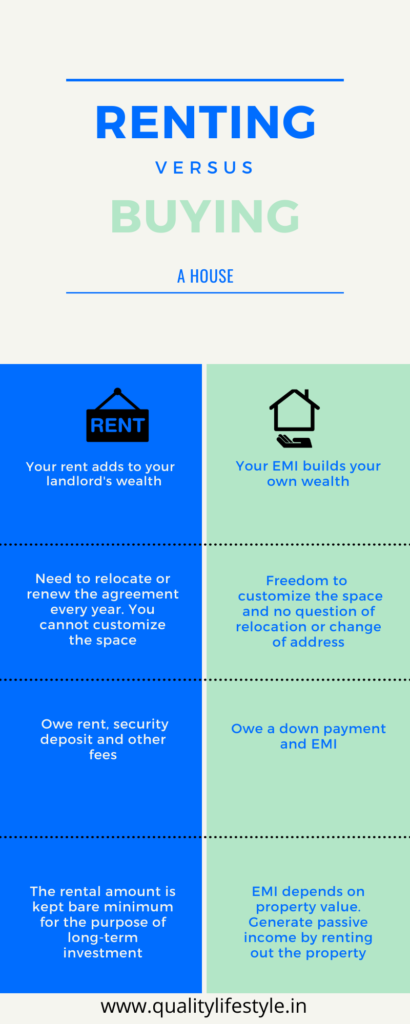

The choice between buying and renting a house is a tough one. In India, most people prefer owning a house than renting. There are definite advantages and disadvantages to both sides. The objective of this post is to evaluate both options.

Pros & Cons When You Rent a Property

- Renting a home will take money out of your pocket every month without adding an asset.

- Renting can make you relocate every year, which entails to loss of time, money and energy. There’s no ease of owning.

- If you are renting a home, which is ready to move in because it is closer to the workplace. Most importantly, a home positioned in a developed locality offers you sufficient time for other important areas of life.

- It is easy to plan various long-term returns like mutual funds (14% per annum) if the rental amount is kept bare minimum, and the remaining disposable income is directed towards other long-term investment.

- When it comes to renting a residential property, there exists a 10% increment every year. i.e Long-term property Compound Annual Growth Rate (CAGR) – 10%

- Renting offers you flexibility in terms of changing locations if your profession demands. It offers the freedom to take career breaks without having to worry about EMIs.

- If you’re renting, you may need to invest consciously in other sources and get higher returns from an investment of tech stocks IPO long-term or as an angel investor in startups.

CAGR is a measure of an investment’s annual growth rate over time. The effect of compounding taken into account. It helps to measure and compare the past performance of investments and also to highlight the expected returns on investment.

Returns on Renting

Returns on mutual fund or any other investments (from savings after paying rent) will be the only savings, and the total rent paid out in 30 years will not add any returns. If you rent a property, then you can invest more in a mutual fund depending on the income, because you will have the option to choose the price of rent as per the monthly income.

Why Pay Rent When You can Pay EMI and Own an Asset?

The most heated statement a well-wisher or any real estate companies make is “Why pay rent when you can pay EMI and own an asset”. The statement holds true because it does make sense, as site value increases every year, but a tenant doesn’t get anything from the rent. However, as you dig deeper there is a slight flaw in this argument, which most people fail to recognize. It is the cost of properties in India and our approach to buying a house. Let’s understand this with an example of Danny.

Danny lives on rent in a 2 BHK apartment for Rs. 20,000 in a good residential suburb in Bangalore. Now in case, he wishes to buy a house where his EMI is the same as that of rent, it becomes quite difficult to find a property in that location.

In this scenario, he has to search for homes that suit his budget in other upcoming neighbourhoods of the city. Bangalore has several self-sufficient neighbourhoods like Whitefield and Sarjapura. Access to tech parks, social & industrial infrastructures and educational institutions has made them lucrative. The choice of home in these areas is also a good mix from budget apartments to luxurious villas.

Key Factors Involved in Buying a Home

High Rental Costs

The home-buying trends are popular in thriving cities such as Mumbai and Hyderabad especially because of the high rental living cost. The monthly rental costs are high in these cities, which is difficult for average middle-class homebuyers. In simple terms, the average monthly rent is equal to the average EMI. As a result, buying a home is the most profitable decision against renting a home.

The rise of affordable housing option in the peripheral locations of the city has increased the number of homebuyers in these capital cities. It offers robust connectivity with reduced average capital.

Rental housing is also popular in these cities, but only in premium locations, which are closer to the city. Some of the cities, which offers more preference for homebuyers are Bangalore, Delhi, Pune and Hyderabad. The migrant working population usually prefer rental properties, instead of home ownership.

In a city like Mumbai, the cost of homeownership is too high as compared to renting a house. For instance, the cost of the average rental of a 2 BHK unit in Mumbai’s Bandra (West) is Rs 70,000 – Rs.90,000 per month.

The cost of buying a 2 BHK unit with built-up area of under 700 sq ft (i.e. Rs 34,000 per sq ft) is around Rs 2.4 crore. The average EMI for this amount is nearly Rs. 1 lakh. If you are locked for 20 years due to a home loan, it is not the best choice. Instead, a city like Bangalore may be the best choice for buying a home.

Returns on Buying

Your home becomes the asset in 30 years. Moreover, real estate investment is a safe investment. An asset has the potential for capital appreciation and tax benefits.

Government Initiatives

The reformatory moves announced by the government in the past such as the Pradhan Mantri Awas Yojana (PMAY), the Real Estate (Regulation and Development) Act (RERA) 2016, the reduced home loan interest rates under the Credit-Linked Subsidy Scheme (CLSS) and income tax rebates up to Rs.5 lakh coupled with the revised Goods and Services Tax (GST) have enhanced home buying sentiment in the country.

- Buying a house takes away a lot of liquidity & adds asset through which one feels safe and secure in life. Buying your own property, on the other hand, provides a lot of emotional satisfaction to your family members, which no other investment would.

- If the property is litigious it needs legal considerations, which is time-consuming, and quite difficult to track the return on investment as compared to other investments.

- If you have a very large capital to be paid as down payment, you can bring down down the cost of interest part of the loan in EMI in the long-term.

- Paying EMI has dual benefits, it not only provides a month of shelter but also increases the proportional ownership in the house.

Home Loan at Early Age + Dream Home = Stress-free Retired Life

Buying a house seems a reality with the help of a housing loan. People avail huge loans that result in large monthly flow towards EMIs. This puts a strain on the savings.

The most important factor is that owning a dream home should be planned at a young age around 28-33 years so that you will have the energy and time to manage EMI for long period and also do savings for retired life.

For a 20-year housing loan of Rs. 1 crore principal amount at 7% per annum, interest is around ₹ 1.4 crore, which is more than the value of your loan along with the property taxes. These numbers are hard to ignore. However, renting is viable or not depends on the rate of interest and loan tenure. Additionally, land prices will sky-rocket over the years, resulting in a disproportionately higher cost per square feet in certain locations.

In conclusion, there is no price to the emotional aspect of owning a home. It is a great asset to you and your children, and a safety net for retirement. Make a wise decision when choosing the builder, location and floor plan of your next home, if you choose to buy one.