Opting for a Home Loan from a Bank? 5 tips to help you make the Smart Choice.

A home of our own is something all of us dream about. Every time we see an advertisement or visit someone in their new home, the dream just gets stronger and stronger.

So here is a fantastic scenario. Your dream home is right here. Our New projects are everything you have visualized. We have ensured that every aspect meets or surpasses your imagination. All that is left is for you to make that final closure.

The final step is looking for a perfect HOME LOAN. It seems so easy to decide on things like which color looks good, what goes where, which light fitting enhances the room decor, and more, but when it comes to the financials one hardly knows where to start.

So, let’s make that easy for you – here is all the information you need to make this decision alone.

Eligibility criteria

Let us look at the 5 most important things to consider when you apply for “A-LOAN” for your “DREAM” house.

The first step is to make sure that you qualify for a housing loan. The initial process of any bank is to check your eligibility for the home loan based on your income and repayment capacity. Lenders also take note of other important considerations including your age, financial position, spouse’s income (if it is applicable), and job security.

The basic eligibility for a housing loan is that the applicant should be between 18 to 60 years and should have a minimum monthly income of Rs 25000. Also, the minimum work experience for the salaried person needs to be 3 years and 5 years for a business person.

Check your credit score

Before approaching any banks for a home loan, you can request for a CIBIL or credit score online from the credit bureau.

CIBIL Score is a three-digit score between 300 to 900 of your credit payment history across loan types and credit institutions over a period of time. A good credit score is essential to get approval for a home loan. A score above 700 is good and below 550, it becomes quite difficult for an individual to get loan approval.

The higher your CIBIL score, the lower the interest rate

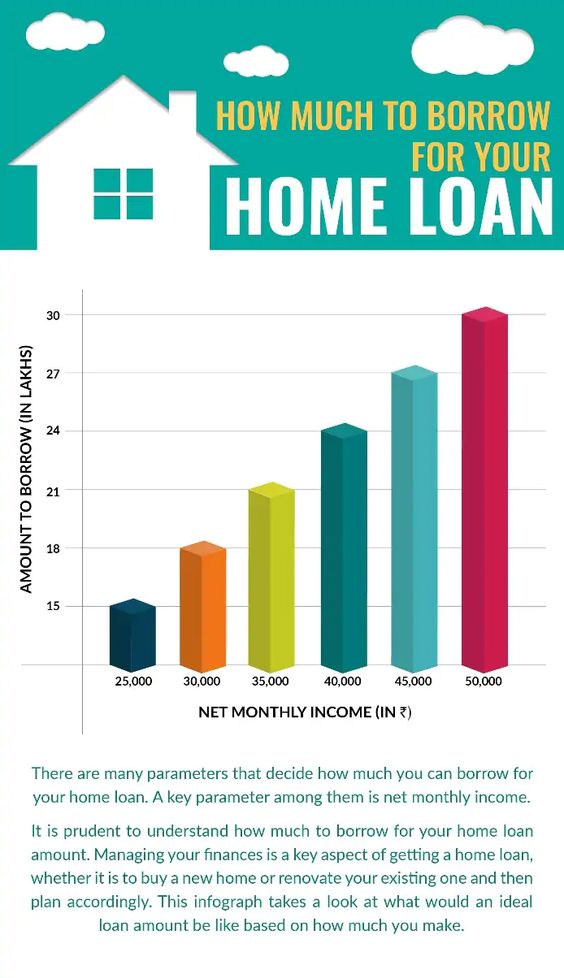

Know your loan amount eligibility

You can check the amount of loan you are eligible for based on your salary and age with the help of online home loan calculators. Ideally, one is eligible for a housing loan whose monthly EMIs are within 50% of the monthly salary. Knowing your eligibility beforehand for the loan amount you’re expecting will ensure a smooth experience and also, avoid last-minute surprises.

If you need a bigger loan, you need to go with an institution that can make special allowances.

A QUICK PREVIEW:

| HDFC | ICICI | SBI | BOB | |

| Processing fee | Rs. 5800 + taxes | Rs. 5000 + taxes | No processing fee | |

| Up to 50 Lacs | 0.5% of Loan Amount or Max 15000 + GST | |||

| Above 50 Lacs | 0.25% of Loan Amount or Max 25000 + GST | |||

| Other charges | Legal Fees, Document handling charges, technical fees extra |

Stamp Duty – Rs. 1200. RMOTD charges – 0.3% of Loan Amount. Property Insurance extra. | ||

| Maximum Loan Availability | ||||

| 1 crore and above | 80% | 75-80% | 75% | |

| Below 1 Crore | 80% | 80% | 80% |

Tenure of loan

A home loan can be sanctioned to an applicant for a maximum period of 30 years. However, the duration for repayment is based on some parameters like the applicant’s age, repayment capacity, credit rating, etc. If you opt for a longer tenure, your EMI burdens will be less and manageable. But you will end up paying a higher rate of interest.

When the banks decide the rate of interest, they take into consideration the loan tenure.

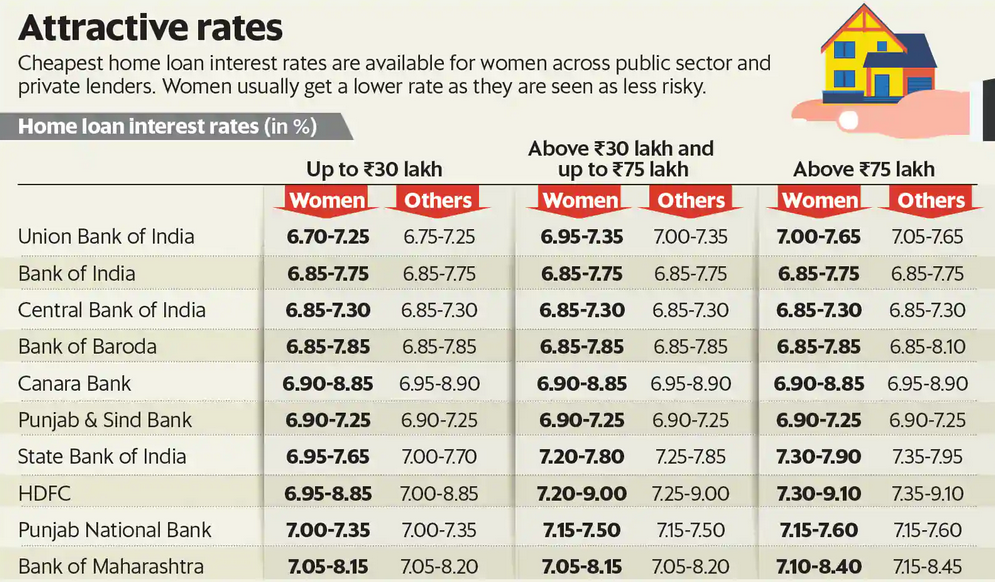

Rate of Interest – The actual numbers

Rate of Interest is the key deciding factor for a home loan and is based on different slabs of Loan Amounts or CIBIL scores. You must check the interest rate before applying for the home loan. The interest rate is going to influence your EMI and the total amount paid by you. To get a better idea on your EMI, you can use the Online Home Loan Calculator. You must also know if the interest rate is fixed or floating. Choosing one of a kind completely depends upon your situation and the market trends on the deciding rate in the last 3 to 5 years.

Key decision criteria:

- Lowest Rate of Interest

- Flexibility of payment

- Value adds and other monetary considerations

- Fixed-rate and Floating Rate concepts – This is subjective to the Institution and needed keener monitoring.

- Repo Rate impact: The choice of passing on the benefits of Repo rate reduction and the % to be passed on is subjective to the Lending Institution. Whether it is passed on automatically or one has to convert every time is also left to the Institution’s discretion.

Lowest Interest Rate is not necessarily the best rate for you. One has to consider the other costs and requirements that may prove to be financially more viable.

INTEREST RATES ***

Bank Of Baroda (BOB)

| CIBIL Score | ROI % | w/o Insurance |

| 726 and above | 6.85% | 6.90% |

| 701 – 726 | 7.10% | 7.15% |

| 650 – 701 | 7.85% | 7.90% |

| (-1) or 0 | 7.10% | 7.15% |

HDFC

| CIBIL Score | ||||||

| 30 Lakhs and below | 780 and above | 750 – 779 | 700 – 749 | 650 – 699 | Below 650 & NTB/NTC | Fixed Rate |

| Women | 7.35 | 7.55 | 7.65 | 7.70 | 7.75 | 7.55 |

| Others | 7.60 | 7.70 | 7.75 | 7.80 | ||

| 30 – 75 Lakhs | ||||||

| Women | 7.35 | 7.70 | 7.80 | 7.85 | 7.90 | 7.70 |

| Others | 7.75 | 7.85 | 7.90 | 7.95 | ||

| Above 75 Lakhs | ||||||

| Women | 7.35 | 7.80 | 7.90 | 7.95 | 8.00 | 7.80 |

| Others | 7.85 | 7.95 | 8.00 | 8.05 |

SBI

| Loan Amount | LTV% | Salaried | Non-Salaried | ||

| HOME LOAN | Women | Others | Women | Others | |

| 30 Lakhs and below | 80% | 7.35% | 7.40% | 7.50% | 7.55% |

| 90% | 7.45% | 7.50% | 7.60% | 7.65% | |

| 30 – 75 Lakhs | 80% | 7.60% | 7.65% | 7.75% | 7.80% |

| Above 75 Lakhs | 75% | 7.70% | 7.75% | 7.85% | 7.90% |

| MAXGAIN | |||||

| 30 Lakhs and below | 80% | 7.70% | 7.75% | 7.35% | 7.90% |

| 90% | 7.80% | 7.85% | 7.45% | 8.00% | |

| 30 – 75 Lakhs | 80% | 7.95% | 8.00% | 7.60% | 8.15% |

| Above 75 Lakhs | 75% | 8.05% | 8.10% | 7.70% | 8.25% |

ICICI Bank

| Loan Amount | Salaried | Self Employed |

| Up to 35 Lacs | RR + 3.45% (7.45%) – RR + 4.10% (8.10%) | RR + 3.70% (7.70%) – RR + 4.35% (8.35%) |

| 35 – 75 Lacs | RR + 3.60% (7.60%) – RR + 4.25% (8.25%) | RR + 3.80% (7.80%) – RR + 4.45% (8.45%) |

| Above 75 Lacs | RR + 3.80% (7.80%) – RR + 4.45% (8.45%) | RR + 3.90% (7.90%) – RR + 4.55% (8.55%) |

Efficiency – what keeps the wheels running smoothly – timeliness

Time is money. Information is key. And together they can literally save us some significant zeros.

It is extremely critical to understand the following:

- Time frames for Loan Approval and Disbursement – Typically, banks take 14-15 days from the date of application to start the payment to the Builder. This includes Assessment, Sanction, Processing, Legal Documentation, and other paperwork.

- Timelines for any upgrades, additions, and changes – especially if it involves changes from Fixed Rate to Floating rate and vice versa

- Foreclosure policy – Is there a foreclosure charge, the rules that govern foreclosure, and the cost implications for the same.

It is important to note flexibility in addition to general norms

A – Add-Ons – The WOW factor for any Consumer experience

Everyone loves a surprise. Value additions or benefits that include those tiny elements that cannot always be measured financially but add to the entire experience in subtle, positive ways.

- A Relationship Manager – Does the Financial Institution have a specific Relationship Manager on your account? That one person you can call at any hour to help with everything from missing paperwork to unanswered doubts about ensuring deadlines are met. The person who will be your go-to person who makes all this happen like an extended family member.

- Tax benefits: **

- Section 80C Tax benefit for Interest Payment

- Tax benefits for Principal Payment

- Special rebate for Female Co-Applicant (should be a joint application)

- Special loans for Interior Decoration and Add-ons to the home – These are individual loans that can be availed for Home Improvement (follow similar patterns for sanction and repayment as the home loan)

- Special Offers like SBI MaxGain – This is a home saver loan product from SBI. Customers under this scheme get an overdraft by SBI with a limit that is equal to the approved loan amount. The amount deposited will be deducted from the home loan amount with a rate of interest on the new principal amount. So, the new EMI would be less than before as the current principal amount would decrease. This scheme is meant to ease the burden of payment of a customer. This amount can be withdrawn at any time depending on the needs or in case of any emergency.

A

Relationship Manager who understands your specific requirements and

restrictions may be a key deciding factor in managing the long-term loan. And

special offers can make that loan a little sweeter.

Mandatory – The PROVERBIAL CHECKLISt

Well, like all “Processes” and especially “Financial Processes” there are the mandatory things one has to tick off before being eligible for a Loan. What the applicant has to provide.

- Paperwork

– Initial paperwork includes the following

- Residence, Identity and Age proof

- Last 6 months Bank Statements

- Last 3 months Salary Slips

- Latest Form 16/ Income Tax return

- The Processing Fee cheque

Since the loan will be sanctioned by Financial Institutions who have already approved the Project – the Property Documents will already be with the Financial Institution.

MOST IMPORTANT – It is mandatory to relax and enjoy your dream home since you have invested in a property that will take care of everything for you. Including being your partner is enabling the financial, infrastructure, and legal support for this Brick and Mortar entity that will be the home you will make your life in.

Decide on a partner who is clear, transparent, and simple with their payment terms and schedules.

Make the choice of a partner who can help you manage your finances and lifestyle the best. And the Dream home is yours. With us, IT IS AS SIMPLE AS THAT.

*(all rates are subject to change)

**(subject to Income Tax regulations)

*** (Above mentioned interest rates will vary basis various parameters such as the Bureau Score, Profile, Segments, etc.)